New research reveals an improved financing environment alongside strong science and technology infrastructure can still help to attract dynamic businesses to Russia despite a low ranking in the Grant Thornton Global Dynamism Index (GDI)

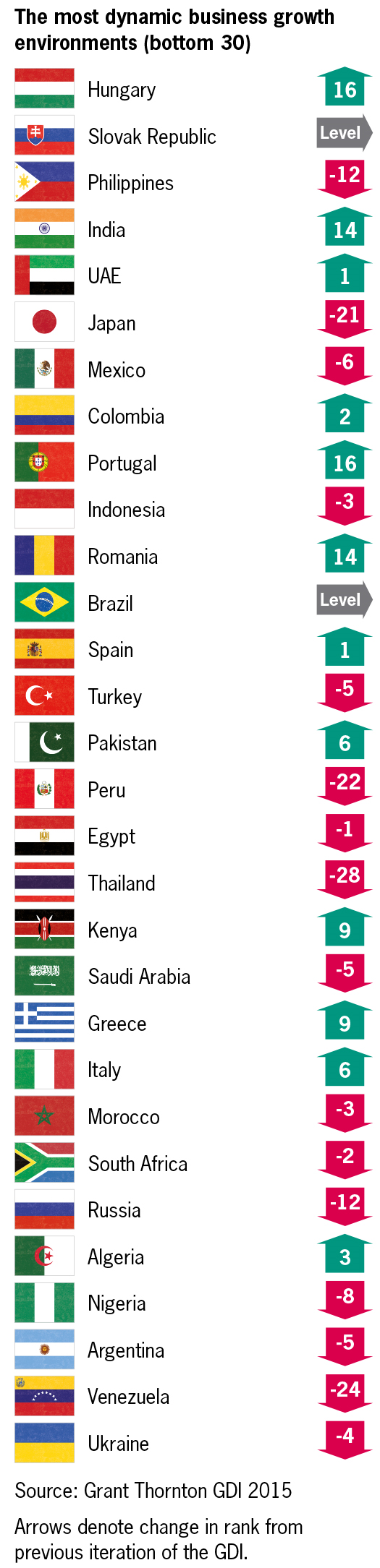

When assessing a range of business dynamism factors in Grant Thornton’s Global Dynamism Index (GDI), Russia ranks 55 out of 60 markets. However, this does not seem to have shaken the confidence of businesses expanding into the country who are keen to highlight the positives, such as access to a key market and key clients while downplaying the difficulties.

When assessing a range of business dynamism factors in Grant Thornton’s Global Dynamism Index (GDI), Russia ranks 55 out of 60 markets. However, this does not seem to have shaken the confidence of businesses expanding into the country who are keen to highlight the positives, such as access to a key market and key clients while downplaying the difficulties.

The GDI shows that Russia ranks highest in the area of technology, due to strong growth in broadband subscriber numbers and consistent research and development spending. The financing environment has also improved over the past two years, with the country rising 11 places in the GDI according to this measure. Among the areas where Russia struggles are business operating environment (52 out of 60) and economics and growth (49 out of 60).

Globally, Singapore offers the best business growth environment for dynamic businesses according to the GDI as a result of a strong financing and regulatory environment. Israel (rank 2) has also risen six places this year. Australia (rank 3=) drops two places but still ranks in the top five for business operating environment and labour market. Finland (rank 3=) and Sweden (rank 5) have both risen slightly, due to favourable business operating environments and an advanced technology infrastructure.

Perception vs reality

However, further analysis suggests business leaders may not be fully aware of the drivers and challenges of operating in Russia. According to Grant Thornton’s International Business Report (IBR), business leaders who either operate in Russia, or plan to over the next 12 months, perceive the country to be a better place to do business than many other major economies. Only 12% of business leaders cite currency fluctuations as a barrier for expansion into the country and less than a quarter (24%) say cash extraction is a factor that puts them off expanding into the country.

Market growth potential is another area where Russia punches above its weight in foreign business leaders’ perceptions. Nearly two-thirds (64%) of business leaders cite access to a key market as a major driver for expansion into Russia. Meanwhile, 58% believe that the country offers them proximity to key clients and around a third (32%) say the geographical closeness to supply chains is an appeal.

Local market spokesperson, said: “In a globalised world, businesses looking for opportunities in dynamic markets must consider a range of economic, social and political factors when making decisions. They must balance instinct with reason, perception with reality.

“At the moment, Russia is benefiting from this perception bias. Businesses clearly feel that there are numerous advantages to doing business in the country that might not be captured in official data. However, as advisors to businesses, it’s our job to make sure firms have the full facts at their disposal when making key decisions.

“The business world is always changing, with the realities on the ground often surprising business leaders who take a closer look. In order to maximise growth potential, business leaders need to refresh their perceptions of foreign markets in line with the market insights at their disposal. Once in tandem, better decisions can be made.”